10 Easy Facts About Offshore Banking Shown

" Among the newest attributes included to specific banks' offerings for little organization owners is Visa card repayment controls." This feature lets small company owners set limits on day-to-day spending, the days and also times of transactions, in addition to the areas or geographic areas where the cards can be made use of. Banks frequently offer brand-new features to their service consumers.

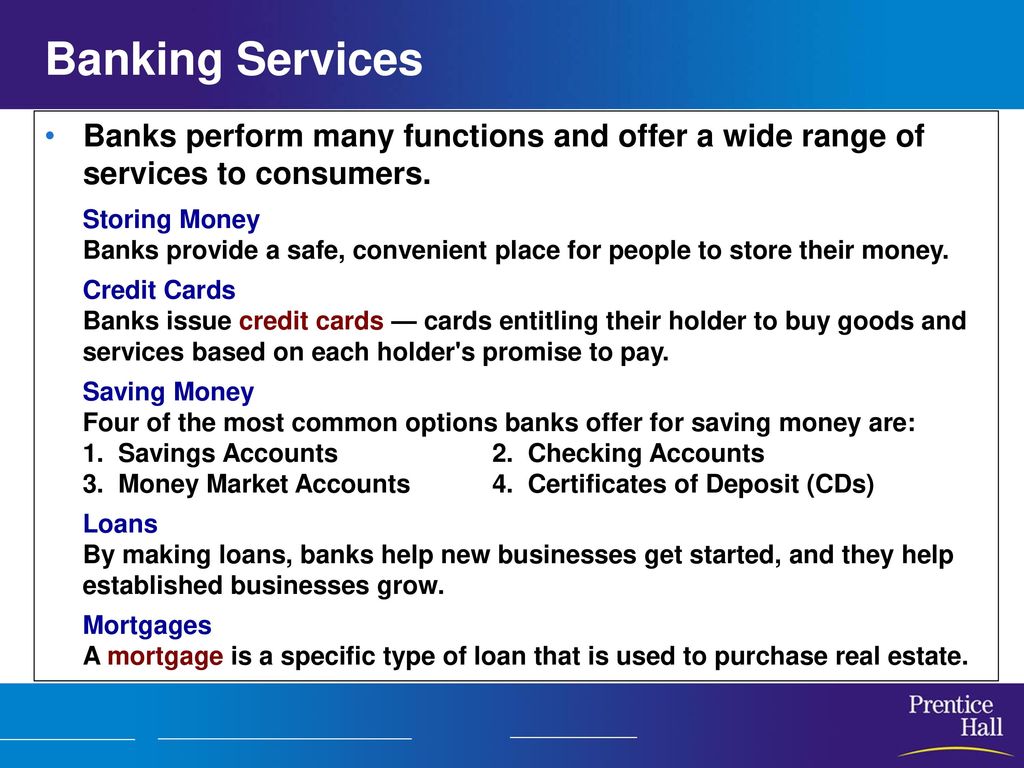

Some common sorts of lendings that financial institutions supply include: If your present financial establishment does not provide the solutions mentioned above, you might not be obtaining the best banking solution possible. Initially Bank, we are committed to helping our clients obtain the most out of their cash. That is why we use different kinds of financial solutions to fulfill a range of demands.

Pay costs, rent or cover up, buy transportation tickets as well as even more in 24,000 UK locations

If you get on the hunt for a brand-new bank account or you intend to start spending, you may require to allot time in your routine to do some research. That's because there are several type of financial institutions and also banks. By understanding the different kinds of banks and also their features, you'll have a far better sense of why they're crucial as well as how they play a function in the economy.

Indicators on Offshore Banking You Should Know

In terms of banks, the reserve bank is the boss. Central banks manage the cash supply in a single country or a collection of countries. They oversee industrial banks, established rate of interest rates and manage the circulation of currency. Reserve banks additionally implement a government's monetary policy objectives, whether that includes combating deflation or maintaining costs from fluctuating.

Retail financial institutions can be traditional, brick-and-mortar brand names that consumers can access in-person, on-line or through their smart phones. Others only make their tools as well as accounts readily available online or via mobile applications. There are some types of business financial institutions that help daily customers, business financial institutions tend to concentrate on supporting businesses.

Much like the conventional controlled banks, shadow financial institutions deal with debt and also various kinds of possessions. They obtain their funding by obtaining it, linking with investors or making their very own funds instead of making use of cash released by the main bank.

Cooperatives can be either retail banks or industrial banks. What identifies them from other entities in the financial system is the truth that they're typically neighborhood or community-based organizations whose members aid figure out just how business is operated. They're run democratically and they use finances and also savings accounts, among various other points.

Offshore Banking Fundamentals Explained

Like banks, credit history unions provide loans, supply cost savings and inspecting accounts and satisfy other economic demands for consumers and businesses. The difference is that financial institutions are for-profit firms while debt unions are not - offshore best site banking.

In the past, S&Ls generally worked as participating organizations. Participants took advantage of the S&L's services and made even more passion from their cost savings than they could at commercial financial institutions. For a while, S&Ls weren't regulated by the government, however currently the federal Office of Second hand Supervision supervises their activity. Not Full Report all financial institutions serve the exact same function.

With time, they have actually been extensively used by both sophisticated get managers as well as by those with even more uncomplicated demands. Sight/notice accounts and dealt with and also drifting price down payments Fixed-term down payments, also denominated in a basket of money such as the SDR Flexible quantities and also maturities An attractive investment extensively made use of by reserve supervisors searching for additional yield and also exceptional credit rating high quality.

This paper presents a method that financial institutions can use to aid "unbanked" householdsthose who do not have accounts at deposit institutionsto sign up with the mainstream economic system. The primary objective of the strategy is to assist these houses construct financial savings and also improve their credit-risk profiles in order to lower their expense of payment services, eliminate a common resource of personal stress and anxiety, and also gain access to lower-cost resources of credit report.

Fascination About Offshore Banking

Second, it will offer them a collection of solutions much better created to fulfill their needs. Third, it is much better structured to help the unbanked ended up being standard bank consumers. 4th, it is additionally most likely to be much more lucrative for financial institutions, making them extra willing to apply it. Numerous studies have actually checked out the socioeconomic features of the approximately 10 million families that do not have checking account.

They have no instant need for credit history or do not discover that their unbanked standing omits them from the credit rating that they do need. Settlement services are likewise not problematic for a variety of factors.

The majority of financial institutions in metropolitan areas will not cash incomes for people that do not have an account at the financial institution or who do not have click for more info an account with sufficient funds in the account to cover the check. It can be quite costly for a person living from income to paycheck to open a bank account, even one with a low minimum-balance need.

Each jumped check can cost the account owner $40 or more since both the check-writer's bank and also the merchant who approved the check generally enforce penalty costs. It is additionally costly and also bothersome for bank clients without examining accounts to make long-distance repayments. Nearly all banks charge at the very least $1 for money orders, as well as several charge as high as $3.

The Best Guide To Offshore Banking

As kept in mind in the intro, this paper says that one of the most effective and also cost-effective ways to bring the unbanked right into the financial system should entail five actions. Below is a description of each of those steps as well as their rationales. The very first step in the recommended approach gets in touch with participating financial institutions to open specific branches that supply the full series of industrial check-cashing services in addition to typical consumer banking solutions.

Comments on “Offshore Banking for Beginners”